About me

Welcome! I am a Senior Economist at the Banco Central de Chile in the Monetary Policy Division. I am working in the Economic Modeling Department. I have just earned my Ph.D. in Economics at the University of Michigan . You can contact me at nelayan@bcentral.cl.

Fields: Macroeconomics, Labor Economics and International Economics.

Before moving to the home of the Wolverines to start the Ph.D. I worked as an intern at the research department of CaixaBank and as a research assistant at IESE Business School in Barcelona.

EDUCATION

- Ph.D. in Economics (2024)

- M.A. in Economics (2019)

- M.Sc. in International Trade, Finance and Development (2015)

- B.A. in Economics (2014)

RESEARCH: WORKING PAPERS

- Strategic or Scarred? Disparities in College Enrollment and Dropout Response to Macroeconomic Conditions. Revise and Resubmit at Labour Economics Download here

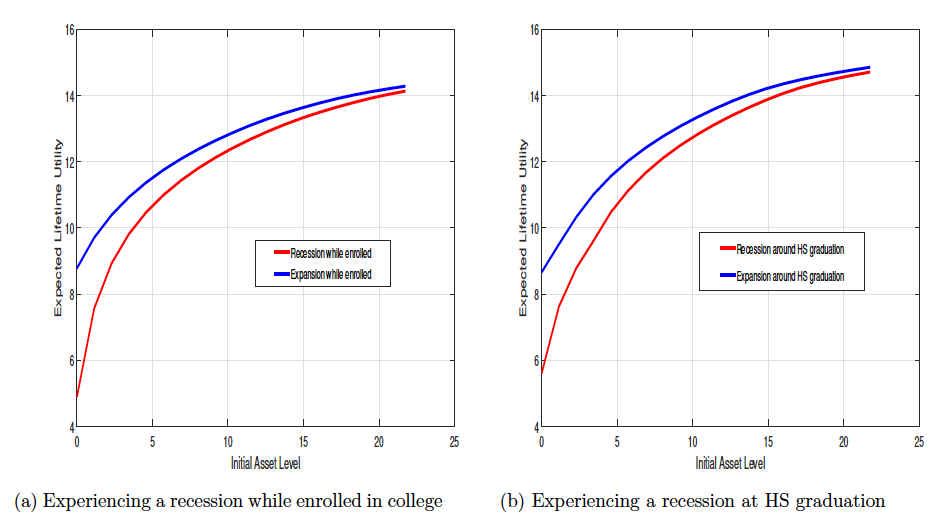

Recessions create enduring effects, or scars, on young individuals’ careers. I investigate how educational choices amplify or mitigate these scarring effects by income. Low-income young people face dual scarring effects: an increased likelihood of dropping out of college and enduring negative labor market entry effects. High- and middle-income young people strategically evade these repercussions by delaying labor market entry through timely college enrollment during economic downturns. I quantify the lifetime repercussions of experiencing a recession during these critical phases using a dynamic life-cycle model with educational choices calibrated to US data. I find that the negative consequences of recessions are largely concentrated on the low-income group.

- Human Capital Misallocation and General Equilibrium Effects in Chile with Agustín Díaz and Carla Varona

We analyze the general equilibrium effects of human capital misallocation in Chile. First, we utilize tax and educational records to estimate the proportion of educationally mis-matched individuals (high-ability individuals with low educational attainment). Second, we estimate the labor market returns on ability, education, and human capital investment. Finally, we construct and calibrate a dynastic overlapping generations model with both private and public human capital investment to decompose the causes of educational mismatch and the general equilibrium effects of changes in sorting.

- State dependent Okun’s law: A selective labor hoarding approach

In this paper I show that Okun’s Law, the relationship between changes in the unemployment rate and real GDP growth, is state dependent: the relationship is stronger during recessions. I hypothesize that this state dependency arises from firms engaging in selective labor hoarding. If firms hoard high-skilled workers outside of recessions to economize on training costs, the Okun relationship will be relatively flat in those times. Such labor hoarding becomes untenable during large recessions, which produces a nonlinear response of unemployment. I build a dynamic model of directed search with heterogeneous firms, endogenous exit, and training costs that generates the nonlinear response of unemployment to changes in real GDP.

- Global Supply Chains and regional shocks with Jose Ramon Moran

This paper explores how regional shocks affect the formation of global supply chains, recognizing the trade-off firms face when choosing the sourcing location of their inputs. On the one hand, sourcing from similar countries entails a lower risk of being exposed to regional shocks. On the other hand, it implies firms are less able to take advantage of the pattern of comparative advantage across the world. Using customs data on Mexican firms we document how firms weigh this trade-off and whether there is sectoral heterogeneity in this behavior. We study whether this heterogeneity is the result of sector-specific input complementarity. We build a model of global sourcing that accounts for comparative advantage being driven by geographical location and exposure to regional shocks. With our model, we explore the effects that an episode of increased regional risk, the global COVID-19 pandemic, had on firms’ global supply chain formation.